is it better to lease or purchase a generator for my operation?

For businesses reliant on uninterrupted power, the decision between leasing and purchasing a generator is crucial. This choice impacts your operational resilience, financial planning, and long-term security. While both options have merit, understanding your specific needs is key to determining the right path. For many operations, the decision to purchase generator equipment proves to be the most strategic and cost-effective long-term investment.

Needs Assessment

Before analyzing costs, clearly define your operational requirements. The right choice depends entirely on your unique situation.

Application: Is power needed for Emergency Standby during grid outages, or for Prime/Continuous power as a primary source?

Duration: Is this a short-term project need or a permanent solution for your facility?

Criticality: What is the financial and operational cost of one hour of downtime? For data centers, hospitals, and manufacturing plants, this cost is often prohibitive, strongly favoring a permanent, owned solution.

Cost Analysis

The financial implications are a primary deciding factor. Let's compare the long-term value against short-term expenditure.

The Case to Purchase Generator

When you purchase generator equipment, you make a capital expenditure (CAPEX). The initial outlay is higher, but it is a one-time investment.

Long-Term Value: Over a typical 15-20 year lifespan, the total cost of ownership is frequently far lower than the cumulative cost of a long-term lease.

Asset Ownership: The generator becomes a company asset on your balance sheet, can be depreciated, and retains significant value.

The Case to Lease

Leasing is an operational expense (OPEX), requiring minimal upfront capital.

Lower Short-Term Cost: It preserves cash flow and credit lines for other uses.

Predictable Budgeting: Monthly payments are fixed for the lease term.

The Verdict: For permanent needs, the decision to purchase generator assets is overwhelmingly more cost-effective over a five-year horizon and beyond.

Control and Customization

Ownership grants complete control, a critical component for a tailored power solution.

When You Purchase Generator

You command the asset entirely.

Full Customization: Specify the exact model, engine brand, fuel tank size, sound-attenuation, and control panel to integrate perfectly with your facility.

Immediate Availability: The system is permanently installed and ready. There are no rental contracts or availability concerns during regional blackouts.

When You Lease

You are bound by the lease agreement's limitations.

Standardized Equipment: You get what is available, which may not be the optimal fit.

Usage Restrictions: Leases often impose strict operational hour caps and penalties for overuse.

Maintenance and Value

Responsibility for upkeep is a key differentiator with long-term implications.

The Owner's Advantage

When you purchase generator units, you manage maintenance. This is an advantage, not a burden.

Proactive Care: Implement a strict maintenance schedule with a trusted provider to ensure peak performance and maximize the unit's operational life.

Asset Retention: A well-maintained generator retains a high resale value, directly protecting your capital investment.

The Lessor's Model

Most full-service leases include maintenance.

Hands-Off Approach: The leasing company manages service and repairs.

No Equity Build-Up: You are paying for a temporary service. Once the lease ends, you have no asset.

When Leasing Makes Sense

Leasing is the superior option in specific, short-term scenarios.

Short-Term Projects: Construction sites, film shoots, or seasonal events lasting under two years.

Equipment Testing: A "try before you buy" arrangement to evaluate a model.

Budget Constraints: When capital preservation is the absolute priority and OPEX is the only feasible path.

Selection Process

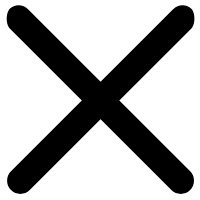

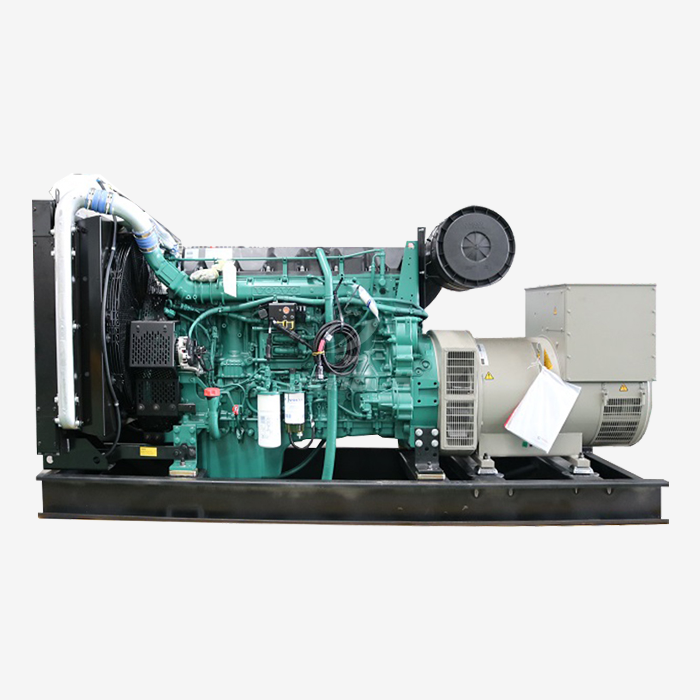

Choosing the right partner is critical when you decide to purchase generator equipment. As a leading diesel generator factory, we guide clients through a meticulous selection process.

Load Assessment: We calculate your precise power requirements to avoid over- or under-sizing.

Site Evaluation: We assess installation conditions, including ventilation, fuel storage, and electrical interconnection points.

Model Specification: We recommend the optimal generator model, controller, and ancillary equipment based on your needs and budget.

Lifecycle Support: We discuss long-term service agreements and parts availability to ensure your investment is protected for decades.

Conclusion

For businesses with a permanent need for reliable backup power, the evidence is clear: the financial benefits, operational control, and long-term asset value created by the decision to purchase generator systems are compelling. While leasing serves a purpose for temporary needs, ownership provides the ultimate security and return on investment.

Our expert team is ready to help you analyze your needs and select the most suitable generator. For a customized proposal, please contact us at skala@whjlmech.com.

References

- Anderson, R. L., & Simmons, G. (2021). Total Cost of Ownership in Industrial Equipment: A Financial Framework. Journal of Business Asset Management, 12(4), 45-60.

- Carter, S. (2020). Operational Resilience: Strategic Investments in Backup Power Systems. Energy Security Review, 8(2), 22-35.

- Peterson, M. (2019). Maintenance Regimes and Longevity in High-Speed Diesel Generators. Power Systems Engineering, 51(1), 88-102.